537 episodes

- Curious? Watch Our Money Makeover Bootcamp!

Ready? Buy Our Simplified Budget System Now!

Amanda joined us to talk through a super relatable moment: they’ve built a solid budgeting system… and now the question is what to do with a big, scary student loan balance once the car is paid off. Add in military life + possible paycheck disruptions, and you’ve got a perfect “real life” money crossroads.

The best part? Amanda’s already doing the work—multiple spending accounts, savings buckets, paycheck-ahead living—and it literally protected their family during a potential shutdown pay delay. Budget bestie win of the year. 🥳

What we covered

A huge win: Being a paycheck ahead so a shutdown/pay delay doesn’t force a panic loan.

The real question: Car #2 will be paid off in July—should they roll that payment straight into student loans Dave Ramsey-style?

Why it feels impossible: Doctorate-level debt + preschool-hours income + three little kids + a spouse who’s gone a lot.

The mindset shift: Doctorate-level debt can be tackled more aggressively when you’re closer to doctorate-level income.

Storm Mode permission: When life is unstable (shutdown uncertainty, limited work hours, heavy family load), it’s okay to pause aggression and pay minimums temporarily.

Quality of life matters: Not as an excuse—as a sustainability strategy. Date nights, small “fun money,” and feeling less tight can keep you consistent for the long haul.

Tactical tip to reduce overwhelm: Even if the loans are “one balance,” they’re often broken into multiple smaller loans inside the account. Tracking them separately can make the mountain feel climbable.

Meet-in-the-middle plan: After the car payoff, consider splitting the freed-up payment:

top off key savings buckets (annual bills, gifts, essentials)

increase spending accounts to reduce day-to-day stress

Let’s Take Our Relationship To The Next Level:

1️⃣ Facebook Group ➡︎ budgetbesties.com/facebook

2️⃣ Be on the Podcast ➡︎ budgetbesties.com/livecall

3️⃣ Private 1-on-1 Coaching. ➡︎ budgetbesties.com/coaching

This... - 🎧 Want the free Podcast Bootcamp + VIP upgrade? Click here.

Today is a short, fun, behind-the-scenes episode where we’re taking you back to the VERY unglamorous beginning of Financial Coaching for Women. 😂🎙️

If you’ve ever wondered how you even found us, why this show feels so “meant to be,” or what it looked like before we had any clue what we were doing… this one’s for you.

In this episode, we cover:

The moment Shana accidentally started a podcast (yes, on purpose… but also not) 😳

Vanessa’s reaction: “How do you accidentally start a podcast?!”

Our first “studio”: a garage + yoga mats + blankets + towels

The umbrella era… because we thought it would stop sound waves 🫠

Why people tell us, “I feel like God led me to your podcast” and why we fully agree

The pivot point when we realized: “Oh… this podcast could actually be a thing”

How we went from 3,000 plays to 1.5 million plays and 500+ episodes later

Want the behind-the-scenes and the blueprint?

If this episode has you thinking, “Okay… maybe I could start a podcast (or finally get serious about mine),” we’re inviting you to join Steph Gass’ free Profitable Podcast Bootcamp (Feb 23–27).

✅ Grab your spot here: stefaniegass.com/budgetbesties

Use code: BUDGETBESTIES for a free VIP upgrade.

We’ll see you over there. And if you’re just here for the origin story, we love you the most. 😉 What To Do With Your Tax Refund So It Doesn’t Disappear: Pay Off Debt, Fund Your Savings Buckets, or Treat Yo’ Self? | 528

2026/2/16 | 15 mins.Curious? Watch Our Money Makeover Bootcamp!

Ready? Buy Our Simplified Budget System Now!

Tax season is here, budget besties—and while it might not be anyone’s favorite, it is inevitable. In this episode, Shayna and Vanessa walk you through a simple, step-by-step plan for what to do with your tax refund (or what to do if you owe), so the money doesn’t disappear the second it hits your account.

We talk about why refunds often vanish without a plan, how “I’ll pay it off when the refund comes” keeps you stuck in a behind cycle, and how to use your budget to decide what comes first. You’ll learn how to choose between the three main refund options—debt, savings buckets, or a splurge—based on what your real life and your full-year budget actually need.

Plus, two pro tips: what to consider if you’re getting a big refund every year (hint: it may be time to revisit withholding), and how to prepare now if you owe taxes so next year doesn’t feel so painful.

The goal? For your tax return to feel like a bonus—not the thing holding your whole financial year together.

Let’s Take Our Relationship To The Next Level:

1️⃣ Facebook Group ➡︎ budgetbesties.com/facebook

2️⃣ Be on the Podcast ➡︎ budgetbesties.com/livecall

3️⃣ Private 1-on-1 Coaching. ➡︎ budgetbesties.com/coaching

This podcast is for educational and informational purposes only and is not personal financial, legal, or tax advice.

This description may contain affiliate links, meaning we may get a commission at no cost to you if you click & purchase.

Click here to view our privacy policy.How to Budget as a Couple: Separate Accounts, Automation, and Debt Payoff - Jamie's Story| 527

2026/2/13 | 27 mins.Curious? Watch Our Money Makeover Bootcamp!

Ready? Buy Our Simplified Budget System Now!

Hey budget besties — today we’re hanging out with Jamie (Twin Cities, MN!) to talk about what it actually looked like to go from “shooting from the hip and hoping for the best” to having a real plan, real peace, and real progress.

Jamie and her husband Kevin have been together since they were teenagers (married 23+ years), and like a lot of us, they weren’t raised with money skills modeled clearly. They’d do “a program” for a while, fall out of rhythm, and then drift back into chaos. Add in big-life curveballs (home repairs, medical stuff, kids getting older, college around the corner), and it hit a breaking point: the stress and uncertainty started feeling too expensive to ignore.

So they brought in coaching — and everything changed.

Let’s Take Our Relationship To The Next Level:

1️⃣ Facebook Group ➡︎ budgetbesties.com/facebook

2️⃣ Be on the Podcast ➡︎ budgetbesties.com/livecall

3️⃣ Private 1-on-1 Coaching. ➡︎ budgetbesties.com/coaching

This podcast is for educational and informational purposes only and is not personal financial, legal, or tax advice.

This description may contain affiliate links, meaning we may get a commission at no cost to you if you click & purchase.

Click here to view our privacy policy.Real Coaching Lessons: Budgeting for Paycheck Gaps + Planning College Visits Without Debt | 526

2026/2/11 | 9 mins.Curious? Watch Our Money Makeover Bootcamp!

Ready? Buy Our Simplified Budget System Now!

Today we're pulling back the curtain and sharing real stories from our private coaching sessions – because if our clients are dealing with it, chances are you are too.

From job transitions messing with pay schedules to college visits sneaking up on us (hello senior year!), we’re breaking down exactly how we helped our clients navigate these challenges without falling into a debt spiral.

We’re talking about:

Why funding your grocery account is non-negotiable

What to do when your paycheck date shifts and the bills don’t care

The sneaky stress of college visit expenses – and how to stop pretending it’s not happening

How skipping a debt payment to build a buffer is actually a smart move

The power of planning ahead (even if your kid is just a freshman)

These are the kinds of wins that may not look flashy on paper — but the

Let’s Take Our Relationship To The Next Level:

1️⃣ Facebook Group ➡︎ budgetbesties.com/facebook

2️⃣ Be on the Podcast ➡︎ budgetbesties.com/livecall

3️⃣ Private 1-on-1 Coaching. ➡︎ budgetbesties.com/coaching

This podcast is for educational and informational purposes only and is not personal financial, legal, or tax advice.

This description may contain affiliate links, meaning we may get a commission at no cost to you if you click & purchase.

Click here to view our privacy policy.

More Education podcasts

Trending Education podcasts

About Financial Coaching for Women: How To Budget, Manage Money, Pay Off Debt, Save Money, Paycheck Plans

***TOP 1% MONEY & FINANCIAL SUPPORT PODCAST***

Do you make good money but have nothing to show for it? Tired of using your bank account & credit card balances as your budget? Want to get debt-free but don’t want to sacrifice everything to do it? Ready to save money and build generational wealth?

You’re in the right place!

We’re telling you exactly how to budget, pay off debt, save money & stop living paycheck to paycheck.

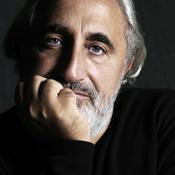

We’re Shana & Vanessa: BFFs, business partners & Dave Ramsey Solutions Master Financial Coaches (and unofficial marriage counselors). We’re glad you’re here.

Podcast websiteListen to Financial Coaching for Women: How To Budget, Manage Money, Pay Off Debt, Save Money, Paycheck Plans, Begin Again with Davina McCall and many other podcasts from around the world with the radio.net app

Get the free radio.net app

- Stations and podcasts to bookmark

- Stream via Wi-Fi or Bluetooth

- Supports Carplay & Android Auto

- Many other app features

Get the free radio.net app

- Stations and podcasts to bookmark

- Stream via Wi-Fi or Bluetooth

- Supports Carplay & Android Auto

- Many other app features

Financial Coaching for Women: How To Budget, Manage Money, Pay Off Debt, Save Money, Paycheck Plans

Scan code,

download the app,

start listening.

download the app,

start listening.